Self Assessment software that’s ready for

Making Tax Digital

CLOUD BASED

Nothing to download, install or configure

IMPORT TRANSACTIONS

from your bank, spreadsheet or software

AUTOMATIC CALCULATIONS

Your Self Assessment tax returns done in real time

SUBMIT TAX RETURNS

fast and easily with

Making Tax Digital

Don’t you just love it when things… work?

Software doesn’t have to be complex. And at #GoFile, we’ve made Self Assessment easier than ever.

Watch this video to discover:

- The fastest way to file a Self Assessment tax return

- The 3 unexpected benefits of Making Tax Digital

How to file your Self Assessment Tax Returns in 3 easy steps

1) Import your relevant transaction history – or input it manually

2) Click the button to sync the information with HMRC

3) Check the tax position sent by HMRC

Done!

#GoFile can file Self Assessment tax returns for individuals, sole traders, property landlords and more.

Whether you just need to claim a few expenses, report dividends, or have a full sole-trader business, you can maintain your transaction history and report information to HMRC right here with Making Tax Digital.

Say Hello to Making Tax Digital.

(and goodbye to traditional tax returns)

Worried about the switch to Making Tax Digital? You needn’t be.

Self Assessment is now easier than ever.

And at #GoFile, we’ll hold your hand and walk you through.

Here’s how it works…

Making Tax Digital is a whole new way of reporting your taxes to HMRC.

Instead of just reporting at the end of the year, you can update HMRC at any time.

This gives you a full, up-to-the-minute accurate picture of your tax position through the year.

As easy as 1,2,3…

1) Log into #GoFile

2) Import or Update your relevant transaction history

3) Your tax position automatically updates with the latest information

Done.

#GoFile your Self Assessment Tax Returns for … Absolutely Nothing

All features absolutely free until April 2023

For Employees & Directors

File for FREE until April 2023- Report Benefits (P11D)

- Claim Allowances & Expenses

- Claim Mileage

For Landlords

FREE until April 2023- Report Income Received

- Claim Allowable Expenses

Support whenever you need it 🙂

Included FREE with every plan- Learn how to file with MTD

- Watch tutorial videos & walkthroughs

- Receive full support from our team

For Investors & Trustees

FREE until April 2023- Report Dividends Received

- Report Capital Gains

- Report UK Trust Fund Income

For Self Employed & Sole Traders

No Charge before April 2023- Report Sales & Expenses in Real Time

- Claim Expenses, Allowances & Adjustments

- Keep on top of your tax position through the year

For AirBnB and Holiday Letters

£0.00 until April 2023- Report your Holiday Let Income

- Claim Expenses

- File Adjustments

For Charitable Donators

Totally FREE (forever)- Report Gift Aid cash donations

- Report Non UK Charity donations

- Report donations of Stock & Land

For Accountants, Agents & Bookkeepers

FREE until April 2023- Flexible tiered pricing based on your usage [see plans]

- Manage unlimited clients from a single login

- Enable *all* features for your clients

- Save up to 80% on standard rates

- Compatible with commercial software like Sage, as well as normal spreadsheets

- Receive priority support from your accounts manager

Help! I have a question…

So... how does Self Assessment work with Making Tax Digital?

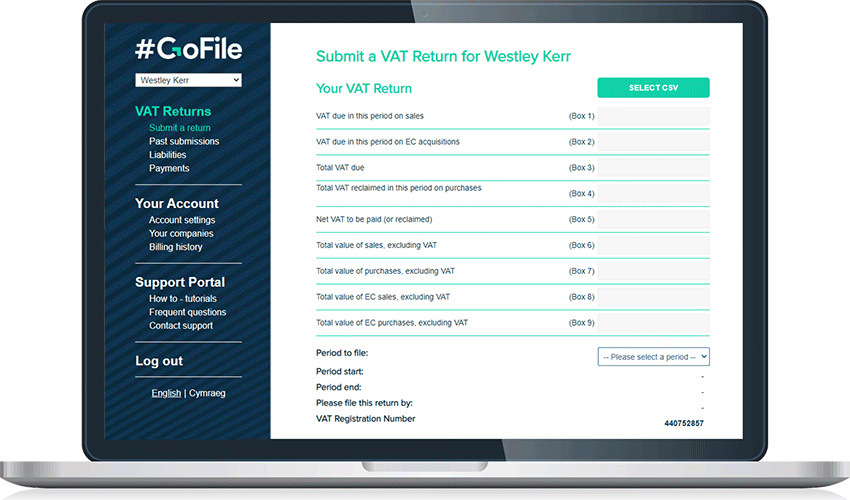

Making Tax Digital is where your tax return is digitally submitted to HMRC, based on a digital transaction history.

You just enter, import or create your transaction history, and your tax profile will be automatically updated with the latest information.

This means you can see at any point your tax position, and helps keep you in control.

Does HMRC see my transaction history?

No. Only summary information (such as total sales in a period) is sent to HMRC.

HMRC never sees your individual transaction history, and would only ever see that if they specifically request it from you, in the event of an audit.

Do I need any other software? Or can I just file direct through you?

You don’t need any additional software to use our service.

#GoFile provides everything you need to file your Self Assessment returns, including the ability to maintain a full digital transaction record.

However, if you do already have software and just need to file your MTD returns, #GoFile is built to work with common bookeeping and accounting software, including Sage, Excel, Apple Numbers and more.

What happens if I make a mistake? Can I change it?

Under Self Assessment, you can update your tax position as many times as you like, throughout the tax year.

So if you make a mistake, or need to change something, you can do this at any time.

Once the tax year is completed, you have up to a full year to confirm the tax year is complete and includes all relevant transactions. Once this is signed, if you then need to make further changes you would need to contact HMRC.

Is there a free trial of the software?

Yes. In fact, you can sign up absolutely free, and try the software with no obligation or commitment required.

I have another question?

If you have a question not listed above, you might find that your question is answered by registering for an account. This is completely free to do, and you can then explore the software and see how it works.

If you still would like to ask a question before registering, please click here to contact us.

Try #GoFile absolutely free

No commitment. No obligation.

Just simple software that works.

No Credit Card Required.

By registering for this service, you agree to our

terms & conditions and privacy policy