HOW TO FILE A VAT RETURN:

The Definitive Guide

This new guide will teach you everything you need to know about VAT Returns in 2024.

First, I’ll show you what VAT is, and the basics of how it works.

Then, I’ll help you get ready to file a VAT Return with Making Tax Digital.

And if you’re new to VAT, or have any follow up questions – feel free to reach out. You can comment below this guide, or contact us to find out more.

Sound good? Let’s dive right in…

CHAPTERS

CHAPTER 1

VAT: The Basics. What it is, and how it works

In this chapter I’ll help you get the basics.

If you’re wondering if you need to be VAT registered, or need some basic information on how VAT works, this chapter is for you.

Then, in later chapters, I’ll show you how to quickly and accurately submit a VAT Return.

What is VAT?

VAT is also known as Value Added Tax. It’s a tax on sales of goods and services.

Any company that sells more than £85,000 in the UK needs to register – although you can also register voluntarily below that threshold if you choose to do so.

If you’re registered for VAT, then whenever you sell anything, you’ll need to account for VAT in the sale at the correct rate. You need to collect this VAT and repay it to HMRC, and give your customer an invoice or receipt that states the VAT included in the sale.

And whenever you buy anything, you’ll usually receive a VAT invoice which shows the amount of VAT included in the transaction. You need to keep this record so you can reclaim the VAT from HMRC.

Who needs to file a VAT Return?

VAT returns need to be filed by any company registered for VAT with HMRC.

You’ll need to register with HMRC if you have a turnover (total sales) in any year of £85,000 or more.

You can also register for VAT if your turnover is below £85,000, and in some cases it would save you money to do so. For example, if you sell lots of items that are zero rated for VAT, but have lots of expenses at the normal 20% rate of VAT, then registering for VAT can mean you get a net refund every month.

How often do I need to file a VAT Return?

Most companies need to file a VAT Return every quarter (every 3 months).

Your VAT periods will usually run from the 1st of a month to the end of the 3rd month. So for example, your VAT periods might be 1st January to 30th March, then 1st April to 30th June, and so forth.

Some companies have to file a VAT Return every month, and some are able to file once per year. This is usually by special arrangement with HMRC – so if you want to do either of these, you can contact HMRC to arrange this.

You can also change the months you wish to file. So for example, if you currently file quarterly, starting in January – but you want to change this to start in February, you can ask HMRC to make this change. It’ll usually take a month or so for the change to go through, and you’ll then have a shorter 1 or 2 month period to file before the new regular quarterly periods begin. This can be useful if you want your VAT periods to match up with your corporation tax year (or your self assessment tax year).

How long do I have to file a VAT Return?

From the end of a VAT period you have 1 month and 7 days to file your return.

So for example, if your VAT period is 1st January – 30th March, then you’ll need to file your VAT Return on or before the 7th May.

Helpful tip: It’s worth getting ahead and filing your VAT Return before the due date, so you’re not filing at the last minute. This helps ensure you don’t hit any HMRC penalty points for filing late.

At #GoFile, we offer a free service to help monitor your VAT Return due dates, and send out reminders when you have a VAT Return due within the next few weeks. Register for free to get these sent to you automatically.

VAT Return Calculations

The VAT you pay (or reclaim) is simply: the VAT on your sales, minus the VAT on your expenses.

Easy, right? Well, let’s illustrate…

Here’s a simple VAT Form as you’ll see in #GoFile:

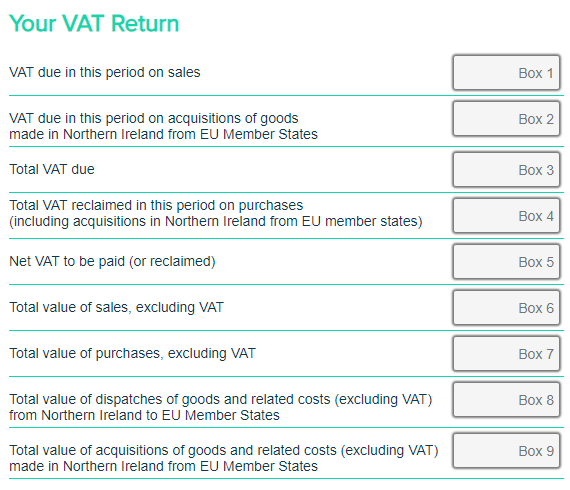

Example VAT Return Boxes

We’ll go through each of these boxes in order…

Box 1: VAT due in this period on Sales

This is the VAT due on the sales you’ve made in the period.

Let’s say you have an invoice as follows:

Item sold: £100 (this is your Box 6 figure)

VAT due: £20 @ 20% (this is your Box 1 figure)

Total invoice value: £120 (this is the amount you receive from your customer)

Or putting it another way, if you’ve received a total £120 from your customer, with VAT at 20%:

Total invoice value: £120 (the total amount received from your customer)

Box 6 Net Sale Value: £100 (to get this, divide the total amount by 1 + 20%, i.e. £120 / 1.2)

Box 1 VAT Due: £20 (this is the total amount, minus the net sale value)

Your Box 1 figure is the VAT you’ve charged on all sales in the period.

Note: If you use the Flat Rate scheme, see the Flat Rate scheme calculations further down.

Box 2: VAT due in this period on acquisitions of goods made in Northern Ireland from EU Member States

This Box is almost always zero (0.00). The only time you’d use this box is if you are based in Northern Ireland, and you have purchased goods from the EU under the Northern Ireland protocol. If this is the case, include the value of the VAT due on those purchases (as a positive figure) in Box 2.

If you have a figure in Box 2, include the same figure in Box 4.

Box 3: Total VAT Due

This box includes the values in Box 1 and Box 2. They are simply added together. Normally, unless you have a figure in Box 2, it’ll be the same as Box 1.

Box 4: Total VAT reclaimed on purchases (including acquisitions under the Northern Ireland Protocol)

Whenever you purchase items, services, or goods in the UK, you’ll usually be charged VAT as a part of that transaction. You can reclaim this VAT through your VAT Return.

As per Box 1, the calculation is normally at 20% of qualifying expenses. You’ll need to check whether you’ve purchased zero rated items, or if your suppliers are not VAT registered for example.

Let’s say you purchased an item for £120 inclusive of VAT @ 20%. The calculation on this is:

Total expense: £120 (this is the amount you paid)

Box 7 Net expense: £100 (to get this, divide the total expense by 1 + 20%, i.e. £120 / 1.2)

Box 4 Total VAT: £20 (this is your Total expense minus Net expense)

Box 5: Net VAT to be paid (or reclaimed)

Box 5 is calculated as a positive figure. It’s the difference between the larger and smaller of Boxes 3 and 4.

So if you are due a refund, please ensure that Box 5 is Box 4 minus Box 3, and this will be calculated correctly.

HMRC will see that Box 4 is higher than Box 3, and therefore know that Box 5 is a refund due rather than tax owed.

Let’s say you’ve got £100 in Box 3 and £200 in Box 4. This would mean you are due a net refund of £100, so Box 5 would be set as £100 (not -100).

Box 6: Total value of sales, excluding VAT

If you’ve got this far, you should have the figure for Box 6 ready to use. It’s the total value of your sales, minus the VAT owed on those sales.

You’ll need to include all sales (including any that are zero rated), other than sales outside the scope of UK VAT.

Note: If you’re using the Flat Rate scheme, please see additional notes lower in this page.

Box 7: Total value of purchases, excluding VAT

Box 7 includes the value, excluding VAT, of your purchases in the period. You’ll need to include all expenses (including any that are zero rated), other than expenses outside the scope of UK VAT.

Box 8: Total value of dispatches of goods and related costs under the Northern Ireland Protocol

Simply – if you sell goods from Northern Ireland to the EU, include the value (excluding VAT) of those sales here. Otherwise, simply leave this box as zero.

Box 9: Total value of acquisitions of goods and related costs under the Northern Ireland Protocol

If you’re based in Northern Ireland, and have bought any goods from the EU under the Northern Ireland protocol, include the value (excluding VAT) of those expenses here. You’ll also need to include the VAT due on those goods in Box 2 and Box 3. Otherwise leave this box as zero.

Example: Create a VAT Return using spreadsheets

You don’t need complex software to generate a VAT Return. You can use Excel, Apple Numbers, Google Sheets, or just about any spreadsheet software alongside Making Tax Digital for VAT.

Here’s an example of how it works… the VAT Return is simply generated from the transaction history, and is ready for submission to HMRC.

This video shows:

- How to create a VAT Return from a spreadsheet

- How to digitally link your VAT Return with your transaction records

- What each box in the VAT Return means, and how it is calculated

- This method works for any spreadsheet, from any source, including Excel, Apple Numbers, Google Sheets, Open Office, etc.

Download the example Excel Spreadsheet used in this tutorial

CHAPTER 2

The Flat Rate Scheme for VAT

Curious about the Flat Rate scheme?

It’s a really easy way to submit VAT Returns – and can even save you money.

In this chapter I’ll talk all about Flat Rate VAT, what it is, eligibility, and how it’s different to regular VAT.

What is the Flat Rate Scheme for VAT?

The Flat Rate Scheme is a very simple, user-friendly way to calculate and submit VAT Returns.

It lets you file VAT Returns just using your total turnover (sales) in the period. You don’t need to include any expenses in your VAT Return.

Instead, under Flat Rate, you just pay a simple percentage of your total turnover.

And the great news?

Your Flat Rate percentage is based on the average expenses in your industry. So if you have lower than average expenditure, you’ll even save money compared with the regular scheme.

Who is eligible for the Flat Rate VAT Scheme?

Before you can use the Flat Rate scheme, you’ll need to apply to do this. You can apply through the HMRC Gateway at: https://hmrc.gov.uk

Most companies with an annual turnover below £150,000 will be eligible to join the scheme.

Other conditions can apply, such as if you’ve left the scheme in the past year.

For full details, see: https://www.gov.uk/vat-flat-rate-scheme/eligibility

What is my Flat Rate percentage?

Your applicable Flat Rate percentage is determined by your business type, and will take into account the average expense ratio in your industry. You can check the Flat Rate percentage for your industry at: https://www.gov.uk/vat-flat-rate-scheme/how-much-you-pay

If you have lower expenses than the average for your industry, the Flat Rate scheme can save you money. If your expense ratio is higher than average, or if you make a lot of zero rated sales (such as exports), it might be better to be on a different VAT scheme.

Also be aware: if you’re a ‘limited-cost business’ i.e. your goods cost less than 2% of your turnover – or less than £1000 per year – you’ll need to pay the maximum 16.5% rate.

Extra tip: You’ll get an extra 1% discount during your first year of VAT Registration.

How to calculate your Flat Rate VAT Turnover

Your Flat Rate VAT turnover is the total amount of sales (including VAT) you make in a period.

You’ll include the value of all your sales (including VAT). The only exception is if you sell services internationally, in which case they are outside the scope of UK VAT, under the Place of Supply rules.

So simply: add together the value of all your sales… and that’s your Flat Rate turnover.

Your Flat Rate turnover is the figure used in Box 6 of your VAT Return – it’s your total sales, inclusive of VAT.

How to complete a VAT Return on the Flat Rate Scheme

If you’re on the Flat Rate VAT Scheme, your VAT Return is usually much easier to calculate than on any other scheme.

Simply, your Box 6 figure is your Flat Rate Turnover (see above).

And your Box 1 figure is your Flat Rate Turnover, multiplied by your Flat Rate percentage.

Box 3 and Box 5 will be the same as Box 6.

You’ll usually be able to ignore all other boxes, so Box 2,4,7,8,9 will all be zero.

The only exceptions tend to be where you have made a capital asset purchase (such as machinery) worth £2000 or more in a single transaction. If this happens, you’re able to reclaim the VAT on that transaction in Box 4, and then enter the value of the transaction (excluding VAT) in Box 7.

Helpful hint: If you’re using the #GoFile example spreadsheet to generate your VAT Return, use the Flat Rate VAT worksheet – and set the Flat Rate VAT percentage to your own one.

Click here to download the example VAT spreadsheet.

CHAPTER 3

How to File a VAT Return with MTD

This chapter is all about filing VAT Returns with Making Tax Digital.

You’ll learn:

- How to get ready for Making Tax Digital

- How to authorise software with MTD

- How to submit a VAT Return

- New features available with MTD

- And more…

What is Making Tax Digital for VAT?

Making Tax Digital is the new way to generate VAT Returns and submit them to HMRC.

It’s intended to make submissions faster, easier, and more accurate. And HMRC says it’s helped businesses file VAT Returns more accurately than ever before.

To put it simply, it means your VAT Return is automatically generated by your sale and purchase history. This means you no longer need to manually calculate your figures with pen and paper – it’s all done automatically for you by your chosen software.

As of April 2022, Making Tax Digital is now a requirement for all companies submitting VAT Returns.

How to get started with Making Tax Digital

If you’re registered for VAT, the next step is to choose some Making Tax Digital compatible software.

There are different software options – and each will have pros and cons.

Here at #GoFile, we try to be one of the lowest cost MTD providers available, while maintaining an exceptional service, and helping our customers file VAT Returns as painlessly as possible.

We currently help over 30,000 companies file VAT Returns each year – but feel free to check out our reviews at Trustpilot as well – so if you feel our service might be suitable for you, you can check out what other users have to say.

Looking for something else? Check the list of HMRC Recognised software providers for more options.

How to authorise VAT software with Making Tax Digital

Once you’ve selected software, you’ll need to just authorise that software with HMRC.

To do this, log into your software, and follow the process they’ll provide. You don’t need to log into the HMRC Gateway first; the authorisation is done from within your software.

Using #GoFile? Here’s how to authorise our service with HMRC…

- Log into #GoFile, and go to VAT > Settings

- Click Authorise with HMRC

- This will load a HMRC Gateway screen – click Continue, and then use your HMRC Gateway ID to log in

- Confirm authorisation – and you’re done.

Once you’ve authorised your software with HMRC, you’ll be able to submit VAT Returns, as well as check the status of past submissions made with Making Tax Digital, and confirm payments made and liabilities outstanding on your Making Tax Digital account.

Watch: How to file a VAT Return with MTD

The video below shows how to submit a VAT Return with Making Tax Digital… in 30 seconds!

This video shows:

- How to register with your software

- How to authorise the software with HMRC

- How to open and edit a VAT Return CSV File

- How to import a VAT Return CSV

- How to submit your VAT Return with Making Tax Digital

- How to check your past submissions

- How to check your Payments and Liabilities on account

- How to check your dashboard figures

Some Making Tax Digital Questions and Answers…

If your question is not answered here, feel free to leave a comment at the bottom of the page.

What are the benefits of Making Tax Digital?

HMRC says that Making Tax Digital will make VAT Returns easier to file, faster to file, and more accurate than before.

Since your VAT Returns are automatically generated from your transaction history, it’ll be easeier to calculate and keep up to date with VAT.

And that’s actually borne out in practise. Even though there’s a small learning curve in getting started with MTD, our users report being more confident in their figures, having to spend less time in calculating VAT, and having a more reliable overview of their VAT position (figures from May 2023).

Do I have to use Making Tax Digital for VAT?

Yes – now that Making Tax Digital for VAT is mandated for all VAT Registered businesses, you’ll need to use MTD to file your VAT Returns.

It’s no longer possible to file VAT Returns through the HMRC Gateway.

Can I opt out of Making Tax Digital for VAT?

If you feel you are unable to use Making Tax Digital, you can present your case to HMRC. They will consider your case – but it’s usually very unlikely you are able to file your VAT Returns outside of the Making Tax Digital service.

How do I file a VAT Return through MTD?

To file a VAT Return through Making Tax Digital – you’ll need to first select a VAT software service, such as #GoFile.

You can then submit your VAT Returns through your VAT software provider – see the example video above.

What features are available through Making Tax Digital?

Making Tax Digital means you can now access your VAT information from anywhere – even your phone. You can, at a glance see:

- Past submission history

- Current VAT Obligation periods

- Your VAT liability positions

- Your VAT payment history

The options and features available to you might be different, depending on the software you decide to use.

At #GoFile, we also provide a free ‘reminder’ service, and will optionally send you reminders of any upcoming VAT Return periods.

CHAPTER 4

VAT Returns 101: Getting Everything Right

In this chapter I’ll cover some of the common questions about VAT Returns, so you can be sure you’re filing correctly.

I’ll also show you how to file a correction, and what to do if you get a penalty point – it happens!

Note: If your question is not answered here, leave a comment at the bottom of the page to contact us.

Q: I am owed a VAT Refund … should Box 5 be negative?

Box 5 is always a positive figure, being the difference between the larger and smaller of Boxes 3 and 4. So if you are due a refund, please ensure that Box 5 is Box 4 minus Box 3, and this will be calculated correctly.

HMRC will see that Box 4 is higher than Box 3, and therefore know that Box 5 is a refund due rather than tax owed.

Q: The VAT Periods in my MTD software seem to be incorrect

The VAT Obligation Periods are sent direct to your account by HMRC.

If the period you want to file isn’t available, or it doesn’t match the dates you’d expect to see, please contact the HMRC VAT Enquiries Team at: https://www.gov.uk/government/organisations/hm-revenue-customs/contact/vat-enquiries

They should be able to reset your obligation periods, so that the full obligation period is available to be submitted. After they make any change, allow 2 hours and the change should be then reflected in your VAT software.

Q: I made a mistake in my VAT Return… help!

Oops!

You file a VAT Return, and suddenly realise… you missed a transaction.

Or maybe you missed off a zero (or two!)

Or maybe you filed for the wrong dates, or even the wrong company entirely.

It happens!

And with over 300,000 VAT Returns filed through our service, we’ve seen hundreds of issues like these.

The good news is, it’s fairly easy to fix. If you file a VAT Return with errors, you can correct this in 2 different ways.

They each have benefits, so if the omission is less than £10,000, just decide which method you prefer to use.

Method 1: Adjust your next VAT Return

You can correct any mistake up to £10,000 value by adjusting the figures for your next VAT Return.

It really is that simple. Just include the transaction you missed out in your next return.

Method 2: Use the HMRC VAT Corrections Service

If the difference in your VAT Return is £10,000 or more, you’ll need to use the HMRC VAT Corrections Service.

You can also use this service if you want to make the correction immediately. This might be useful if – for example – you meant to reclaim VAT, and instead paid VAT. If you file a correction immediately, you will receive the repayment faster than if you wait until your next VAT due date.

You can access the HMRC VAT Correction service through https://gov.uk/vat-corrections/

Q: I received a penalty point from HMRC. What does this mean?

Penalty points are HMRC’s way of nudging you gently to say something’s wrong. Usually it means a return was filed late, or maybe your VAT payment is overdue.

You’ll need to fix the issue as soon as possible – such as by filing any overdue VAT Returns.

After a period of time, penalty points will expire and disappear from your record. So, as long as you address the issue quickly, there won’t be further ramifications.

Q: How do I dispute a charge or penalty point?

If you’re sure the penalty point is a mistake, you can contact HMRC to correct the record. You’ll need evidence that you took any action in good time – such as a record that you’ve filed a VAT Return on time, for example.

QUESTIONS?

Get expert help with your VAT Return

You’ve come to the right place.

With around 300,000 VAT returns filed through our service, there’s not much we don’t know about VAT, VAT Return calculations, and submitting VAT Returns to HMRC.

So – if you have any further questions about VAT, feel free to comment below, and we’ll be delighted to help.

How can I use a Free version of #GoFile

Hi there – just register as normal, the account you start with is completely free. You can upgrade to the paid version, but there’s no obligation to do so. To see what is included in each plan, please see https://gofile.co.uk/pricing/

Hi,

I’ve tried to reauthorize my HMRC to use Gofile but the following message comes up.

‘Authorisation could not be saved, The HMRC gateway ID does not have the Making Tax Digital service available too it for VAT number******’

The ID must be correct because HMRC sends me a 6 digit pin code and then it says its complete.

Please help.

Hello,

Thanks for getting in touch!

HMRC allows you to authorise the service with *any* HMRC Gateway ID, regardless of whether it has access to your VAT information.

You’ll likely have multiple HMRC Gateway IDs, so if you double check which one is used for managing your VAT account, and authorise with that, it’ll work well.

Alternatively, double check your VAT number as stored in #GoFile exactly matches the one HMRC holds for you, as any differences can mean that the service can’t retrieve your VAT information.

If neither of those suggestions helps, please log into your account, and open a support ticket through Contact Support. We can then identify your account, and provide more specific guidance.

Thanks!

I’m registered for VAT under the Flat Rate scheme. I raise a handful of invoices per year (using Word) and have few expenses (hence Flat Rate).

Though MTD isn’t applicable to a business under £50K turnover (includes me) I now have to file online.

I see your software covers Flat Rate. Can you let me know what’s involved with using your software and costs?

Tanks – Alan

Hi Alan,

Thanks for reaching out!

To use our service, it’d likely be easiest to use our example Excel VAT Return spreadsheet.

If you’re on the Flat Rate VAT scheme, you’d just enter your sales, and your Flat Rate VAT Return is then automatically calculated.

You can then upload the VAT Return to our service for submission to HMRC.

To get started, just register (free) and you can then download the example spreadsheet from the How To – Tutorials page. The second video on that page shows how to enter your sales into our example spreadsheet, and how to then save your VAT Return and submit to HMRC.

Please let us know if you have any further questions. Thanks!

Ok, first of all, THANK YOU. There’s some information on here that I haven’t found elsewhere. Been trying to work out how to file VAT returns, and you just made it easy! Next: I’m about to file my first VAT Return, and how do I pay HMRC? Is it automatic?

Hi Tracey, great to hear from you! When you submit your VAT return, it’ll be instantly confirmed by HMRC – you’ll see a little success message. You can then go and see the VAT return if you go to Past Submissions, just click View and you’ll see the receipt from HMRC to confirm it’s been received and is being processed.

Processing the return takes around 72 hours usually (sometimes more at busy times). Once processed, you’ll see your VAT liabilities page updates with any VAT you owe.

If you have already set up a direct debit, HMRC will normally email you on or around the 7th of the month to confirm collection of any money owed.

The payment can take up to 14 days to clear from your account, although it normally clears within around 5 business days, so around the 12th or 13th.

If you haven’t already set up a direct debit, you can make a one off payment through https://gov.uk/pay-vat/

Once you’ve made any payment, allow 72 hours again, and it will show up in your VAT > Payments page in #GoFile.

I hope that helps! Please update the comment if we can help further – or open a support ticket at any time from within your account.

HOW DO I SET UP A VAT SPREADSHEET? USED ANNA AND THERE WAS A VAT SPREADSHEET TEMPLATE ON THERE

Hi there

Thank you for your message – and welcome!

If you log into #GoFile, you’ll find our example spreadsheet in the Submit a Return page, where there are an example CSV file and XLS file. You’ll also find it in How To – Tutorials, below Video #2, which walks through how to use the spreadsheet.

Kind regards

How do I integrate gofile with HMRC

Hi there!

Thank you for reaching out.

To authorise our service with HMRC, you’d first log into your account.

Then go to VAT > Settings > Authorise with HMRC.

You then are shown a popup window from HMRC. They’ll ask you for your HMRC Gateway User ID and password. Please use the details you would normally use for managing your VAT account with HMRC.

Click through, and you’ll confirm authorisation. Then once that’s done, you’ll be redirected back to #GoFile, and the service will double check that the authorisation is valid.

If so, you’ll instantly be able to view your VAT Return obligation periods, and submit returns to HMRC through #GoFile.

For further details, as well as a video walkthrough, please see the additional information at https://gofile.co.uk/vat/how-to-file-vat-with-making-tax-digital-mtd/

Thanks!